Jeg laver kurset dvs læser bogen grundigt grundigt grundigt …

Failed final flag:

“A protracted trend often forms a horizontal flag that extends sideways for several bars, breaks a trendline, and then breaks out to a new extreme but quickly reverses in the next few bars. This Failed Final Flag breakout often marks the end of the trend and sometimes leads to a reversal. In most cases, there will be a tradable, extended Countertrend move that will have at least two legs. A key point is that the flag is usually mostly horizontal and often can be as simple as an ii pattern.”

2: “Failed Final Flags: after the breakout from the flag, the market comes back to the flag and usually breaks out of the other side.”

Flere ordforklaringer

Expanding triangles:

An expanding triangle can be either a reversal or a continuation pattern and is made of at least five swings (sometimes seven, and rarely nine), each one greater than the prior one. Part of its strength comes from its trapping traders on each new breakout. Since it is a triangle, it is a trading range, and most breakout attempts in a trading range fail. This tendency results in the expanding triangle. In a bullish reversal, an expanding triangle bottom, it has enough strength to rally above the last higher high, trapping longs in; it then collapses to a third low, trapping longs out and bears in on the lower low, and then reverses up, forcing both sides to chase the market up. The new low is the third push down and can be thought of as a type of three‐push pattern, and it can also be thought of as a breakout pullback—the market broke above the last swing high and then pulled back to a lower low. In a bear reversal, an expanding triangle top, it does the opposite. Bears are trapped in by a lower low then are forced out, and bulls get trapped in by a higher high, and both then have to chase the market as it reverses down for the final time. The initial target is a breakout beyond the opposite side of the triangle, where the market often tries to reverse again. If it succeeds, then the reversal fails, and the pattern becomes a continuation pattern in the original trend. All expanding triangles are variants of major trend reversals, because the final reversal always follows a strong leg.

########################

Her er brooks eget glossary:

http://brookstradingcourse.com/price-action-trading-terms-glossary

Her er det nye kursus:

https://www.brookstradingcourse.com/td365-advanced-course/

se login i keepass

Her er et billede a

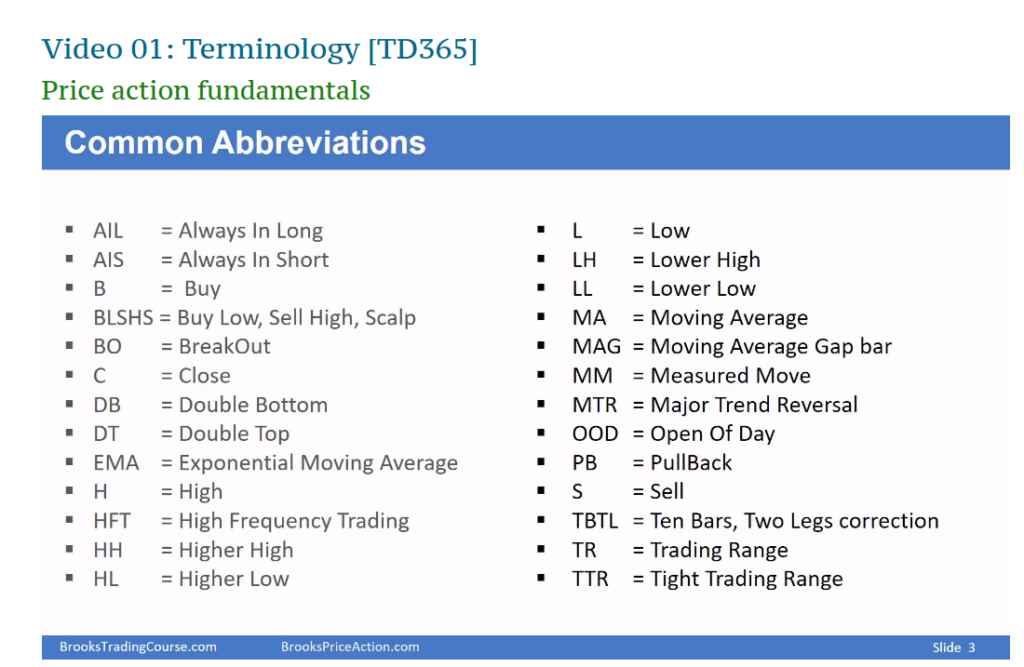

her er et billede af hans forkortelser: